30+ subprime mortgages definition

Web A subprime lender is a lender that offers loans with subprime rates to borrowers who may not qualify for traditional loans such as borrowers with subprime. Subprime mortgage loans the most common.

Subprime Mortgage Originations Annual Volume And Percent Of Total Download Scientific Diagram

With a regular mortgage the term is.

. A non-qualified mortgage or non-QM is a home loan that is not required to meet agency-standard documentation requirements as outlined by the. Web The subprime mortgage loan definition includes several different types of subprime mortgages which well get into later. Web Subprime borrowers may be more likely to be offered adjustable-rate mortgages which can be riskier than fixed-rate loans because their interest rate could rise in the future.

In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people in the United. Web Definition of Subprime Mortgage. The higher interest rate is intended to.

Additional credit characteristics of a. Web subprime lending the practice of extending credit to borrowers with low incomes or poor incomplete or nonexistent credit histories. Such individuals have low income limited.

Lock Your Rate Today. These mortgages are usually offered for an extended period of 40- or 50-year term compared to the standard 30-year for conventional. A fixed-rate prime mortgage is the most common type of home loan.

Web Non-QM Loan Definition. A second approach to identifying subprime lending is to focus on borrower attributes regardless of the lender. Apply Get Pre-Approved Today.

Web subprime loans and some subprime lenders also originate prime loans. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Consumers with a credit score between 580 to 669 are considered subprime borrowers and are at greater risk of default.

Web Subprime originations appear to be heavily concentrated in fast-growing parts of the country with considerable new construction such as Florida California Nevada. Web A subprime loan is a loan offered to individuals at an interest rate above prime who do not qualify for conventional loans. These mortgages allow less-creditworthy borrowers to buy a.

These days subprime loans come with more. Its interest rate is stable over the life of the loan. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Compare the Best Home Loans for February 2023. Web A subprime mortgage comes with higher interest rates and is given to borrowers with poor credit. Web A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records.

Web These loans are considered a driver of the subprime mortgage crisis that devastated the housing market from 2007 to 2010. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Most mortgages are either prime or sub-prime in character.

Subprime Mortgages A Primer Npr

Fewer Subprime Consumers Across U S In 2021 Experian

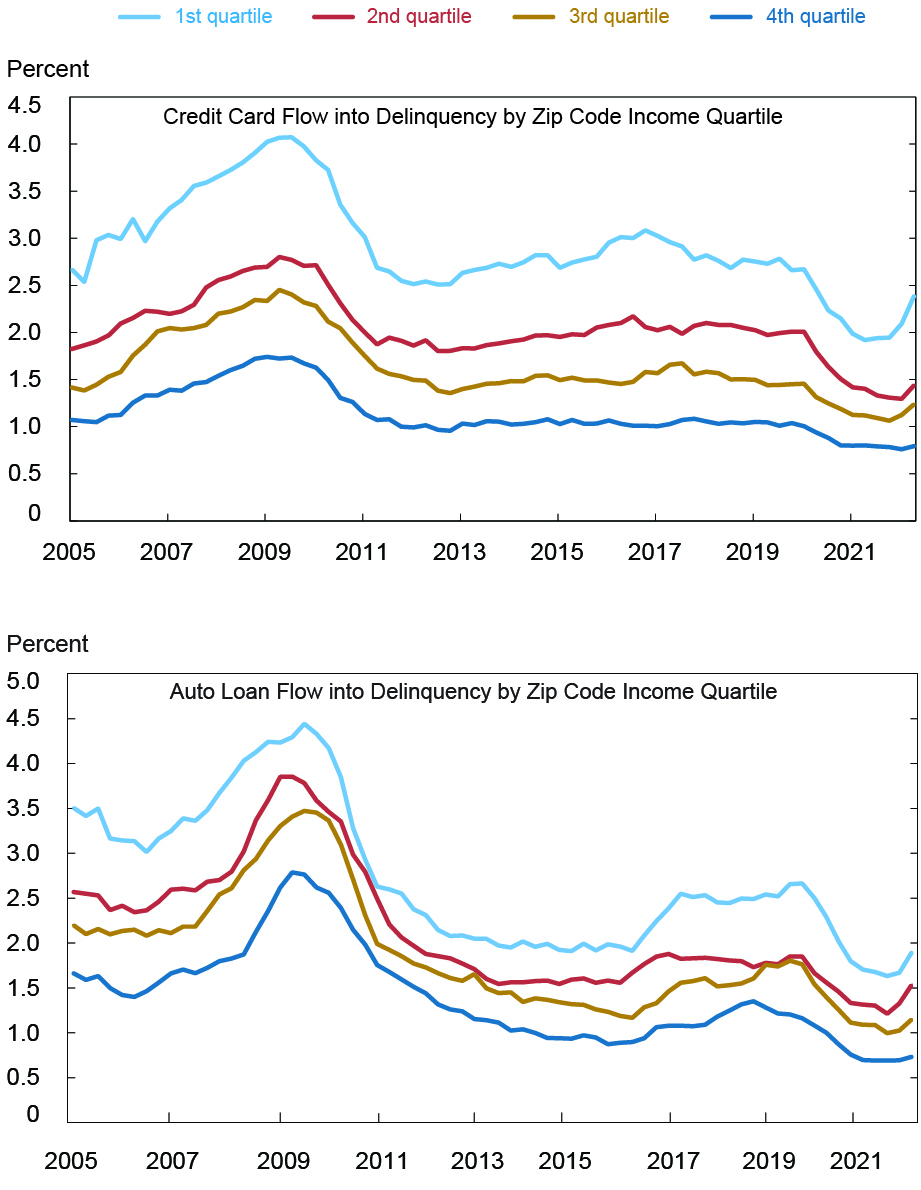

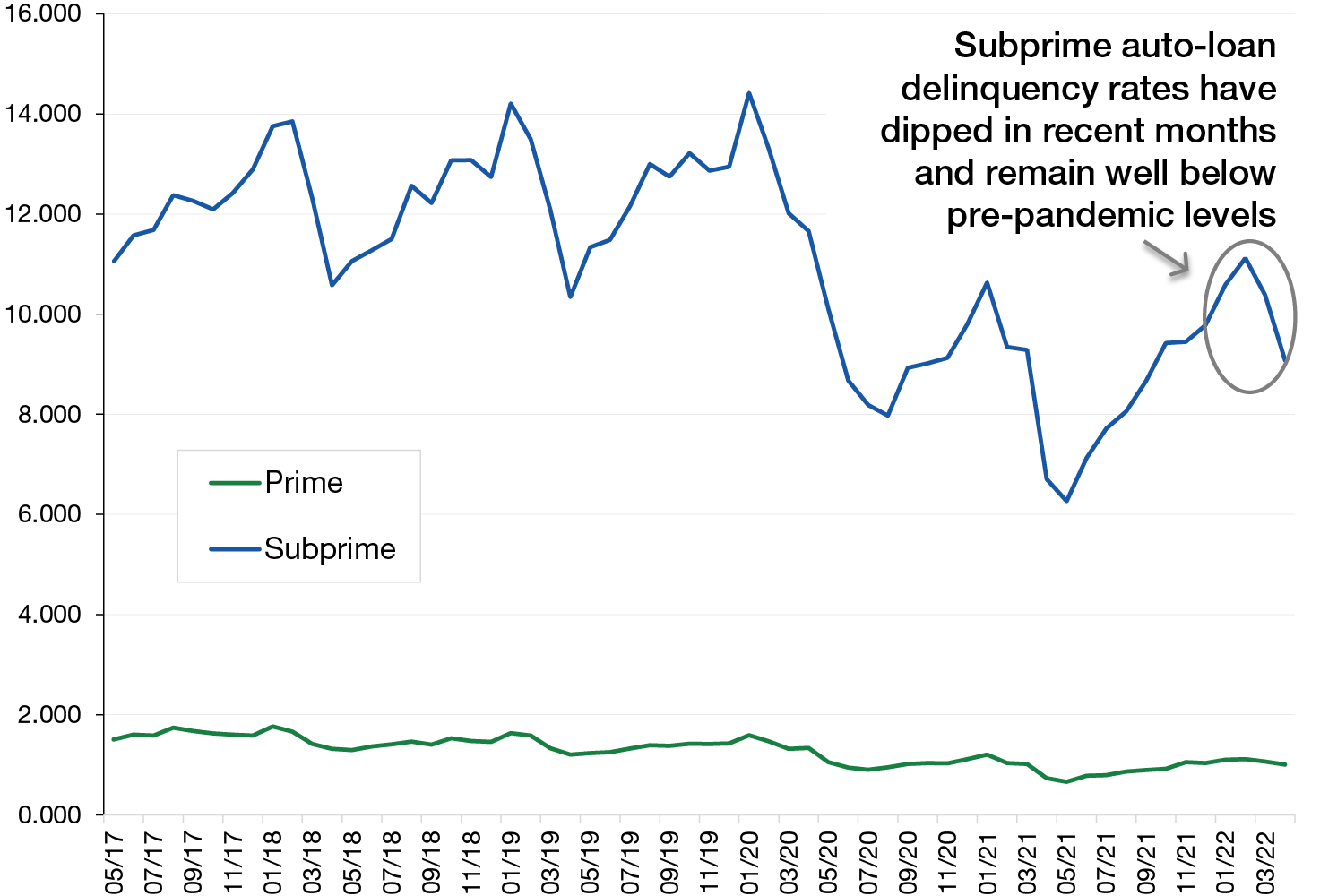

Historically Low Delinquency Rates Coming To An End Liberty Street Economics

Subprime Mortgage Crisis Wikipedia

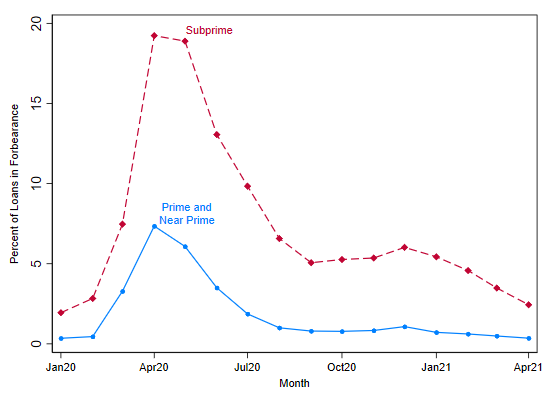

What Happened To Subprime Auto Loans During The Covid 19 Pandemic Federal Reserve Bank Of Chicago

Exhibit 99 1

What Is A Subprime Mortgage Credit Scores Interest Rates

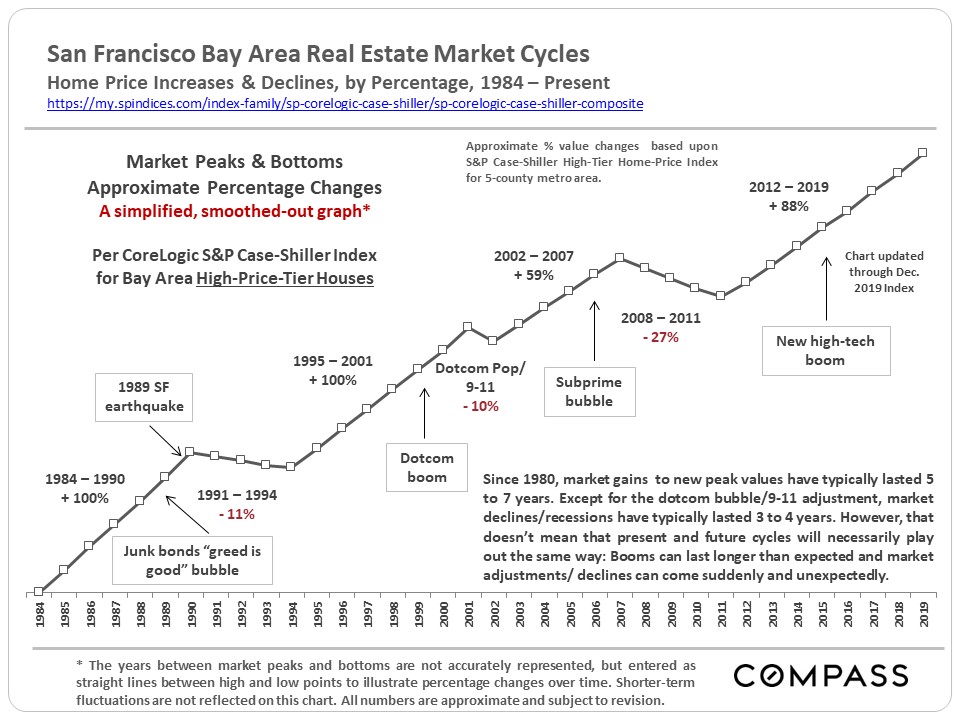

30 Years Of Bay Area Real Estate Cycles Compass Compass

What Is A Subprime Mortgage Nextadvisor With Time

Subprime Mortgage Definition Types How It Works

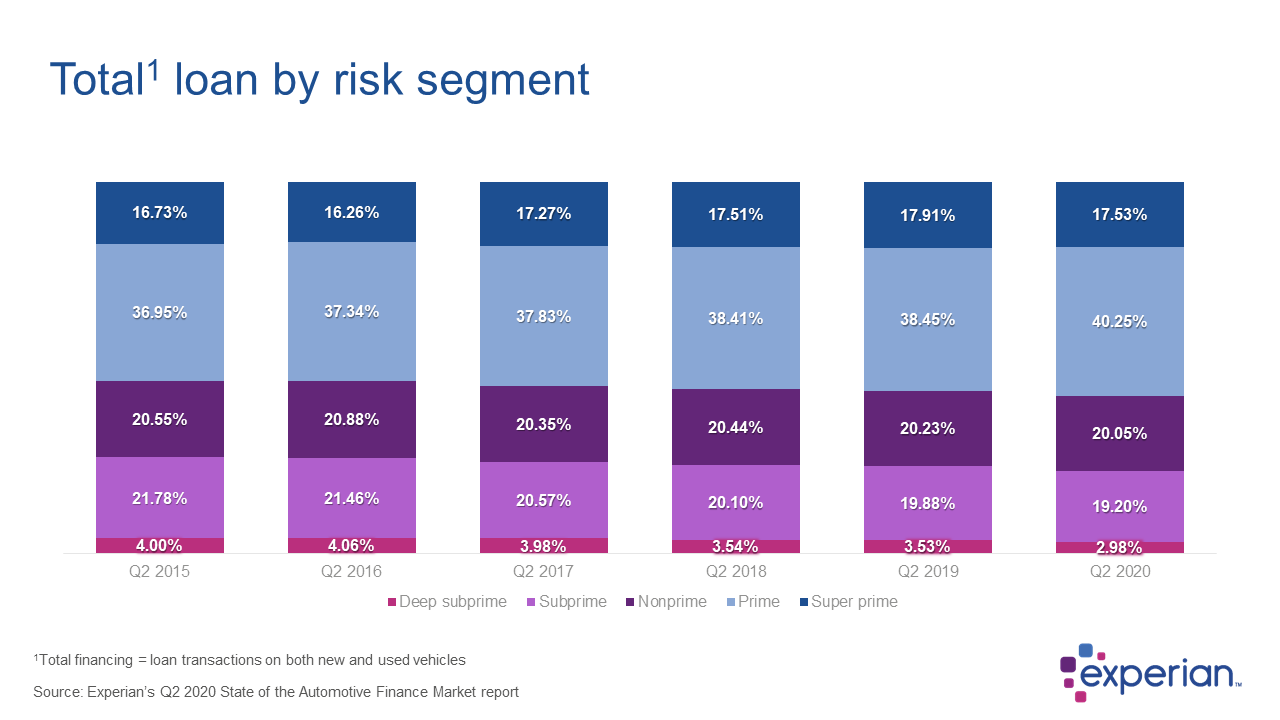

Subprime Borrowers Locked Out Of Loans That Might Not Be The Case Experian Insights

What Is A Subprime Mortgage Your Credit Score Is Key

Subprime Mortgage Definition Types How It Works

Asset Backed Securities Consumer Strength Signals Opportunity In Auto Loans

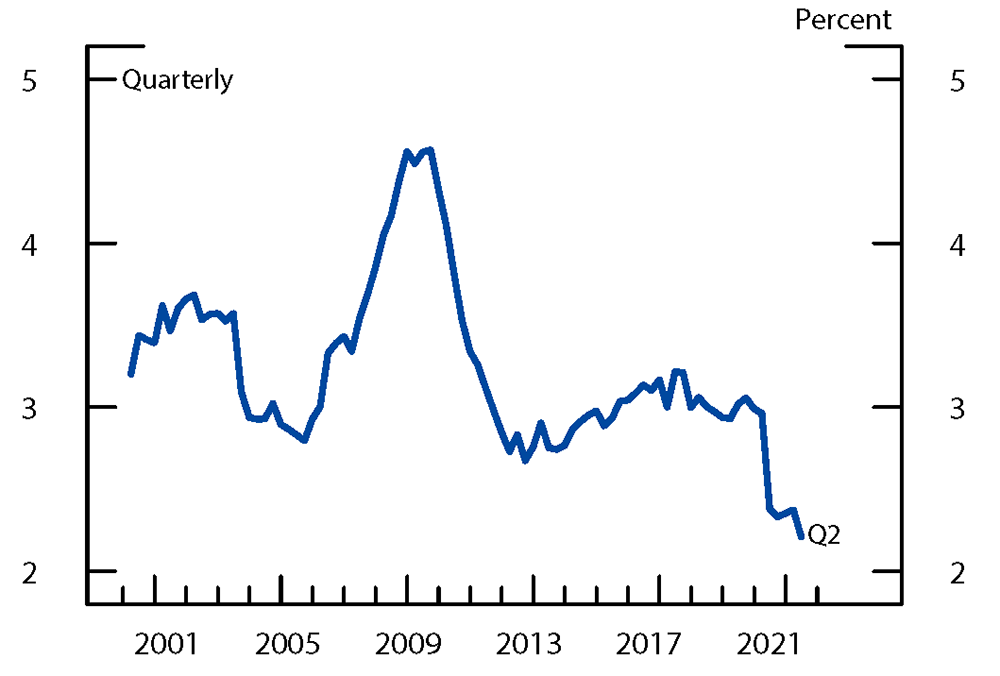

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market

Q2 2021 Credit Industry Insights Report Summary

Subprime Mortgage Crisis Wikipedia